Personal lines of credit: Personal lines of credit are generally unsecured. Which means the lender only works by using information about you, including your credit, money and exceptional debts, to come to a decision regardless of whether you qualify. This information and facts could also have an affect on your credit limit and annual proportion amount.

A line of credit is a type of loan where you have entry to a preset credit limit to utilize after which you can repay time and again. Since lines of credit are open-finished debt, they don’t have an outlined payoff date. They’re accessible to the account holder providing the account is in very good standing.

Even so, this doesn't influence our evaluations. Our views are our individual. Here is an index of our associates and here's how we earn cash.

A house fairness line of credit or HELOC, is usually a revolving line of credit, much like a credit card, apart from it’s secured by your house.

Kim Lowe is a lead assigning editor on NerdWallet's loans crew. She covers client borrowing, together with matters like own loans, student loans, invest in now, pay back later on and funds progress apps. She joined NerdWallet in 2016 after fifteen decades at MSN.com, exactly where she held several written content roles which includes editor-in-chief of the health and fitness and foodstuff sections.

Put together your documentation. You’ll want to gather your business approach, financial institution read more statements for both you and your business, specifics of earlier loans, the latest tax returns, available collateral, and business licenses. You might also will need to describe how you propose to use the loan.

Discounts account guideBest financial savings accountsBest high-produce cost savings accountsSavings accounts alternativesSavings calculator

Residence fairness get more info lines of credit (HELOCs) are a typical kind Apply now of secured credit account. Using this type of loan, a borrower can attract cash from the equity they may have in their dwelling.

Unsecured lines of credit don’t demand collateral. Apply now For this reason, They could have greater interest premiums than secured lines of credit do.

House equity loans and lines of credit are approaches to use the value in your home to borrow cash. Find out about the various possibilities, the benefits, and also the risks of each and every.

When analyzing presents, you should evaluate the financial establishment's Stipulations. Pre-competent features are not binding. If you discover discrepancies along with your credit rating or data from the credit report, make sure you contact TransUnion® specifically.

An SBA loan has an extended repayment term than most regular loans but needs to be useful for distinct and authorised functions. Businesses have diverse loan selections, such as the seven(a) loan for expenditures like Operating funds, partner buyouts, and refinancing professional property.

College student loans guidePaying for collegeFAFSA and federal student aidPaying for profession trainingPaying for graduate schoolBest private university student loansRepaying university Business Loan student debtRefinancing scholar financial debt

Angel buyers and enterprise cash firms are prevalent types of equity financing that require receiving income in Trade for fairness in your business.

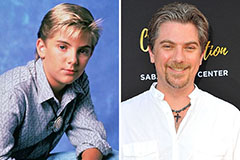

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!